Tax Incentives & rebates

Discover Tax Incentives for EV Charging Investments

Playlist

2:24

3:45

5:19

17:29

12:58

0:39

If you purchase and install a QCharge® electric vehicle (EV) charging solution between Jan. 1, 2023, and Dec. 31, 2032, your business may be eligible to receive a 30% tax credit up to $100,000 under the 30C Alternative Fuel Infrastructure Tax Credit. Commonly referred to as the “federal tax credit,” the credit now requires applicants to be located in designated census tracts (guidance and maps forthcoming from the IRS) and follow prevailing wage standards.

Find out more about Form 8911 for EV Refueling Property Credit here.

Investing in electric vehicle (EV) charging infrastructure may appear to incur substantial expenses, but it is, in fact, more economically viable than one might assume. Governments and utility companies extend an array of financial incentives, encompassing tax credits, rebates, and grants, with the aim of mitigating the initial costs and ensuring widespread access to sustainable charging solutions. Our dedicated “Incentives and Rebates” webpage provides comprehensive information on the available alternatives, empowering you to make an enlightened choice and embark on a path towards a more ecologically balanced future.

Were you aware that substantial financial advantages await those who invest in EV charging infrastructure? By capitalizing on state-sponsored rebate programs and federal tax incentives, you stand to potentially recoup up to 70% of your initial expenditure. In some cases, diligent individuals who secure rebate funds prior to installation may even enjoy a complete waiver of upfront costs, ensuring that no funds emerge from their own pockets.

Unlocking Affordable Sustainability

EV charging can also provide financial benefits beyond the incentives and rebates offered by governments and utilities. Many businesses and property owners who offer EV charging can generate revenue through charging fees, attract and retain customers, and increase property values.

Additionally, with the growing popularity of electric vehicles, installing charging stations can be a competitive advantage for your business or property. Learn more about the benefits of EV charging on our website and explore the possibilities for your business or property

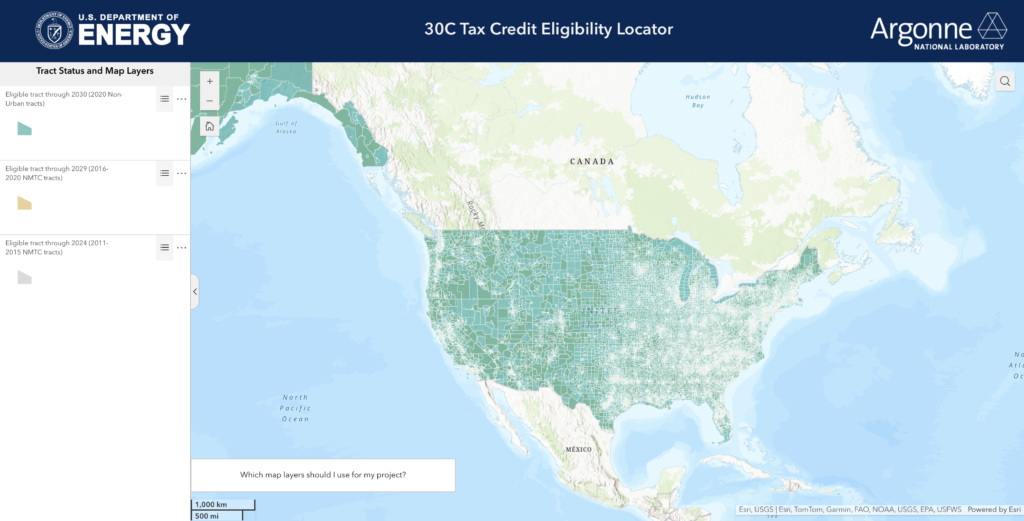

First, the map shows “low-income community census tracts” for two different determinations of such tracts, based on delineations of census tract boundaries conducted at two different times. These two determinations and census tract boundary delineations are:

- “2011-2015 NMTC tracts,” referring to the low-income community population census tract determinations by the Community Development Financial Institutions Fund (CDFI Fund) for the NMTC program based on the 2011-2015 American Community Survey 5-year estimates and the 2015 delineation of census tract boundaries. This determination can be used for qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022, and before Jan. 1, 2025.

- “2016-2020 NMTC tracts,” referring to the low-income community population census tract determinations by the CDFI Fund for the NMTC program based on the 2016-2020 American Community Survey 5-year estimates and the 2020 delineation of census tract boundaries. This determination can be used for qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022; such tracts are anticipated to remain eligible locations for the 30Ccredit through 2029, after which the NMTC updated census tracts will provide the determination of low-income community census tracts.

Second, the map shows “2020 non-urban census tracts,” referring to Treasury/IRS determinations of Census tracts based on 2020 Census Bureau determinations of ‘urban areas’ and 2020 delineation of census tract boundaries. This determination can be used for qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022; such tracts are anticipated to remain eligible locations for the 30C credit until the Census Bureau’s determinations of 2030 urban areas are released.

For more information on how low-income community determinations are made and how census tract boundaries are delineated please refer to IRS Notice 2024-20.

30C tax Credit Eligibility Locator

You can access the map of eligible 30C Tax locations via this link